Benefits of Filing Form 1042-S Online

With our premier and time-saving features, filing Form 1042-S online is simple.

Easy & Secure Filing

Use our cloud-based e-filing software to quickly and securely complete your

1042-S Forms, then send copies to the recipients by foreign mail

or online.

USPS Address Validation

You can verify that you have entered the correct address for filing 1042-S

through USPS

Address Validation.

Built-in Error Check

Before sending your return to the IRS, File 1042-S verifies the form using IRS business standards to improve accuracy and decrease the chances of rejection throughout the filing process.

Postal Mail/Online Access

We send the recipients copies by postal mail and seamlessly through a secure

online

access portal.

Secure Online Portal

You can go paperless because our secure online portal lets your recipients view and download their 1042-S forms.

Autogenerate 1042 -T

Transmittal Form 1042-T will be automatically generated by our system when

you E-file Form 1042-S with us. You can access it anytime for

your reference

How do you file 1042-S Online for tax year 2023?

Follow these simple steps to begin filing Form 1042-S Online. Once you have reviewed and transmitted your

Form, we will update you on

its status with the IRS.

Choose “Form 1042-S”

from the dashboard

Enter Form 1042-S information

Review 1042-S Form Information

Transmit your Form to the IRS

Deliver Recipient copy (online/

postal)

Ready to E-file Form 1042-S with the IRS?

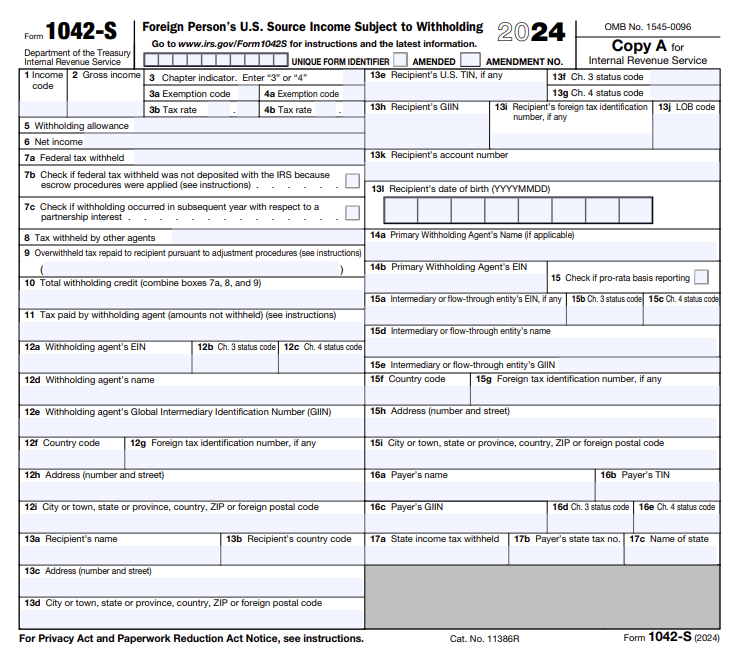

What information is required to File Form 1042-S Online?

-

Payers Information: Name, Address, Tax identification number, GIIN Number.

-

Recipient Information: Name, Address, Tax identification number, GIIN Number.

-

Income Information: This requires the income code that classifies the

payment type. -

Withholding Information: This determines the amount of tax to be withheld from payments made to nonresident aliens.

-

Withholding agent information: Name, EIN, GIIN

-

Primary Withholding Agent information: Name (If applicable), EIN

-

Intermediary or flow-through entity information: Name, GIN, EIN (if any)

-

State Withholding Information: State income tax withheld, Payer’s state tax number, Name of

the State.

Frequently Asked Questions to File 1042-S Online

Form 1042-S, also known as "Foreign Person’s U.S. Source Income Subject to Withholding,” is generally filed by the withholding agents to report any payments paid to foreign persons. This applies to non-resident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts subject to income tax withholding.

A 1042-S form must be filed to the IRS, and a copy must be distributed to the recipient whenever an entity such as an employer, educational institution, or company withholds taxes on payments made to a foreign entity. This form guarantees adherence to tax laws.

Form 1042-S should be filed regardless of whether tax is withheld or not. The details in Form 1042-S include the payer and recipient information, income, withholding agent, and state withholding information. Learn more about the 1042-S Instructions in detail here.

The Due date for filing Form 1042-S with the IRS is March 15 for the 2023 tax year. This is also the due date for furnishing all recipients with a copy of the form. If this date falls on a weekend or government holiday, the due date will be the next business day.

The withholding agent can be penalized between $60 and $330 for each Form 1042-S if they submit it after the deadline or with inaccurate information. The penalty amount is determined by the time between the deadline and the form's filing date.